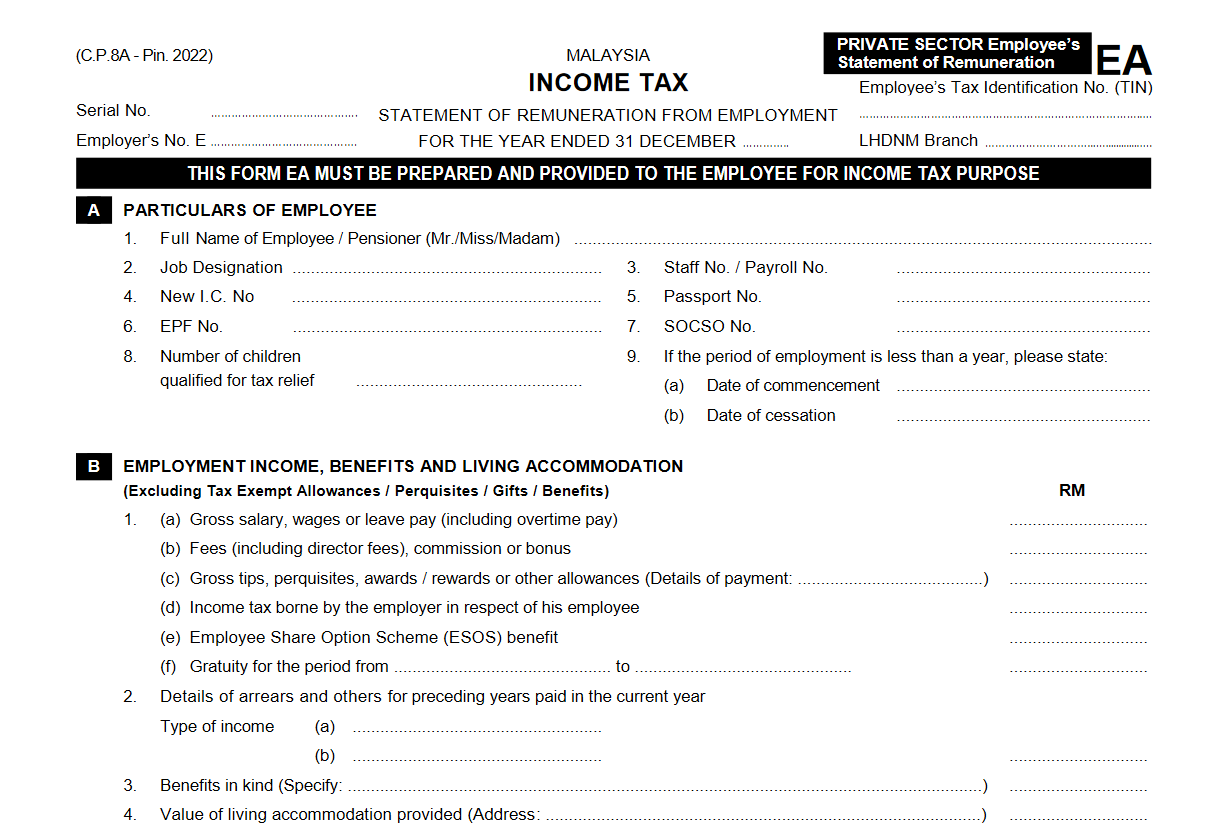

The EA form is a statement of salary or annual compensation for private-sector employees. It contains information related to salary, bonuses, commissions, benefits, allowances, monthly tax deductions (PCB LHDN), and EPF contributions. The EA form also includes information about other benefits provided by the employer to the employee.

LHDN EA 2022: 5 Important Preparations to Help You Complete Your Income Tax e-Filing

Individuals who receive an annual income of RM34,000 and above after deducting EPF contributions are required to pay income tax. The income tax rate for each individual varies according to category – usually around one percent for income between RM5,001 and RM20,000 or up to 30 percent for annual income exceeding RM2 million.

During the income tax e-Filing season, Borang EA is one of the important documents that needs to be available, especially for individuals working in the private sector. For individuals who are filing their income tax for the first time, here are some tips you can follow:

1. Prepare EA Form(or EC Form)

The EA form is important for completing income tax forms or income tax e-Filing. According to Section 83(1A) of the Income Tax Act 1967, employers must provide and distribute the EA form no later than March 1st each year. This is because individuals who are eligible for income tax must submit their tax forms no later than April 30th.

The EA form is important because it contains all the necessary details and information related to salary, bonuses, rewards, and facilities provided by the employer. For example, the employer may provide facilities such as a car, EPF contributions, income tax deductions, and so on. In other words, all the information is stated in the form – so there is no issue of hiding salary information.

In addition, the EA form is also important for car loan or a house loan applications. Banks usually require borrowers to provide the EA form.

*Note: EC form refers to the Government Employee Tax Form for the Annual Salary Statement.

2. Log in to Income Tax E-filing

As a first-time taxpayer, you need to create a profile first to enable you to access the e-Filing portal. Once registered, you can start filling in the information into the e-Filing system by referring to the details stated in the EA form or EC form.

Make sure that the amount entered during the e-Filing process matches the amount displayed in the EA form or EC form. Once the information is completed, users can find out the amount of income tax payable to the Inland Revenue Board (LHDN).

Individuals who pay PCB exceeding the actual tax rate will receive a refund of the excess tax paid. Therefore, it is important for you to fill in the e-Filing to allow you to claim back the excess PCB paid each month. The e-Filing service for the 2022 assessment year will begin on 1 March 2023.

3. Identify Eligible Expenses for Tax Deductions

Get to know the types of expenses in the current tax year that are eligible for tax deductions, including rebates. Basic tax deductions offered by the government include expenses for children’s needs, school and education fees, medical insurance, life insurance, zakat, lifestyle expenses, and hotel accommodation during travel.

Takaful and Insurance Statements

You can request an annual statement from your takaful or insurance agent. You can claim a refund for subscriptions to life takaful/insurance, education insurance and medical insurance, but not for car takaful/insurance renewals.

Lifestyle Receipt

You are eligible to claim a lifestyle relief of up to RM2,500. Any lifestyle purchases such as mobile phone purchases, laptops, tablets and sports equipment, book and internet subscriptions, and so on, are eligible for tax relief.

Basic Supporting Equipment Receipt

This relief is for female taxpayers only. It involves the purchase of nursing equipment for children aged two years and below. The maximum claimable amount is RM1,000.

Kindergartens or Daycare Centre Receipt

If you have a child aged six years and below who is attending preschool or daycare, you can make a tax relief claim. The maximum deduction for this claim is only RM1,000.

However, you need to ensure that the childcare center is registered with the Department of Social Welfare (JKM) or the government and private preschools that are registered with the State Education Department.

SSPN-i Statement

In addition, the net savings deposited into the SSPN-i account can also be claimed. Net savings refer to the amount saved after deducting any withdrawals, not just the amount deposited into the account each month. For the 2022 assessment year, the maximum amount that can be claimed is RM8,000.

Current Year Savings Amount – Current Year Expenditures Amount

For example, the carried-forward balance in your SSPN-i account from 2021 is RM4,500. You saved RM2,000 in 2021 and spent RM1,500 on your children’s school expenses. The eligible tax relief deduction that can be claimed is only RM500 (RM2,000 – RM1,500).

Zakat Payment Receipt

All types of zakat payments, such as zakat fitrah, zakat on income, zakat on gold, and zakat on savings made during the assessment year can be claimed. You can obtain a receipt or statement of payment from the State Zakat Center when making the payment.

Although LHDN does not require taxpayers to submit these receipts when filing their e-Filing, it is recommended that you keep the payment receipts as proof. This is because you may be asked by the IRB to submit them in the future for audit purposes.

Every year, LHDN will randomly select individuals to submit receipts and all related documents for review. If you do not have payment receipts, you may be fined or penalized for making a false claim for tax exemption.

The maximum expenditure limit and list of tax reliefs are usually updated by LHDN every year. This list may change depending on the current government policy. To find out the full list of tax reliefs for the assessment year 2022, you can refer to the article Tax Relief List 2022 for e-Filing 2023.

4. Make an Installment Payment Appeal, If Necessary

It is recommended that taxpayers wait until the final amount of income tax to be paid, after deduction, has been determined before submitting their tax filing. This is because if the amount of monthly tax deduction (PCB) is insufficient, the difference between the monthly deduction and the actual tax payable will need to be settled with LHDN within 30 days of submitting the tax form.

Failing to settle the payment within this period may result in a penalty of a 10% increase on the outstanding tax amount. However, individuals who encounter payment difficulties can request installment payment of their taxes by appealing to LHDN.

5. Options Available for Married Taxpayers

Married taxpayers have the option to file their taxes jointly or separately. Usually, taxpayers choose to file jointly if their spouse is not working or has a low income. This allows them to claim a tax relief of up to RM9,000 for their spouse’s dependents. However, if both taxpayers are employed and have eligible income, they usually opt to file separately.

Tax relief claims for children’s dependents can be split between spouses, and they can also claim tax relief for their respective parents’ dependents. Filing separately is also done to avoid being subjected to a higher tax percentage rate if both incomes are combined.

Don’t Wait Until the Last Minute, File Your Taxes Early to Prevent Issues and Get Maximum Tax Relief

Furthermore, you are advised to file your e-Filing early. Avoid filling out e-Filing on the last day of tax submission. This is because taxpayers may be at risk of issues such as limited internet access and unstable websites. If you have any inquiries regarding the EA form or income tax payment, you can refer to the website of the Inland Revenue Board for further information.

Additionally, if you wish to get medical and health insurance to maximize your tax relief, visit the Qoala website for further information. Qoala is the best insurance comparison and renewal platform in Malaysia.

EN

EN

MY

MY