With tax relief, you can get the maximum financial return for the year. So, how to claim tax relief? In this article, Qoala will provide a list of tax reliefs that you may be able to claim. In addition, this article also shares how to fill out e-Filing for your guidance.

Who Has to Pay Income Tax?

This income tax is an annual tax that needs to be paid to contribute to the country. According to the IRB, individuals with an annual income of more than RM34,000 after EPF deduction (or a gross monthly income of RM2,833.33 after EPF deduction) must pay annual tax.

Anyone who is eligible to pay tax but fails to do so, may be subject to legal action. You have to make sure that you carry out your responsibility by declaring your income. The following are among the types of income tax imposed:

- Income is earned from a business or profession

- Dividends

- Discount

- Royalties

- Pension

- Rent

And speaking of which, any income you earn outside of Malaysia will not be taxed. You only need to declare all types of income including part-time or freelance work that you earn in Malaysia.

Tax Relief Meaning

So, what is tax relief? Tax relief means the reduction of the amount of money released in the assessment year, from the total annual income. For example, there are certain expenses you incur that can be deducted from your total annual income. This means that your total income tax can be reduced because you have made tax-exempt expenses.

In simple language, whoever gets tax relief, the amount of income tax will be reduced. This means they can save a huge amount of money. Basically, there are three main groups of Malaysian citizens who can claim tax relief/rebate:

- Individuals with single status

- Married couple with dependent parents

- Those who have children

How to Fill Out e-Filing 2024?

E-Filing by LHDN is a platform for you to fill in information related to taxation. As a taxpayer, you need to submit the 2021 Remuneration Year and Assessment Year 2021 tax returns through the e-Filing system. The date of e-Filing starts on 1 March 2022 and the deadline for e-Filing 2022 is on 30 April 2022. Below are the 6 steps of e-filing for your guidance:

1. Visit the ezHasil Website and e-Filing Login

Before you log in for the first time to the e-Filing system, you need to get a PIN number first by applying for an e-filing pin number. You can do it online through the Feedback Form on the HASiL official portal or click “First Time Login” on the ezHasil website and follow the next instructions. Apart from that, you can also do it physically by going to the LHDN branch counter.

After you have received the e-Filing pin number, you need to:

- Login to the ezHasil website by clicking “First Time Login”

- Enter your pin number and ID number and click “Send”

- Go to the “e-Filing” section and click on “e-BE Assessment Year 2021”

- On the e-Form page, click “Year of Assessment” and select the year 2021

2. Fill In Your and Your Partner’s Information

If you are married, you can fill in information about yourself and your partner. However, if your partner also works, it is highly recommended to separate because there are significant differences such as tax relief that you can take advantage of.

In this section, you need to:

- Fill in all personal details such as name, income tax number and so on

- For those of you who have a partner. In the “Assessment Type” section, choose whether to do separate or joint e-Filing

3. Fill in Other Profile Sections and Make an Incentive Claim (If Any)

Often, expatriates whose taxes are borne by the employer. You can refer to the EA form. If you want to fill in this section, you need to:

- In the “Other Profile” section, fill in details such as phone number, employer number, taxes borne by the employer

- In the “Incentive Claim” section, refer to “Appendix” before filling in details such as “Incentive Type”, “Claim Code” and so on

4. Fill In Your Total Income

This is where you declare all the income you earned last year. You need to:

- In the column “Statutory income from employment”, enter the amount of income you receive from your company after the EPF deduction

- If you have worked for more than one employer, enter the number of companies you have worked for in the “Number of employment” section

- Also enter other income such as Bonus, side income, rental house and so on

5. Tax Relief Claim

refer to that section to see what you can claim. You can fill in the following sections:

- Individual and dependent relatives

- Tuition fees (Self)

- Lifestyle

More information will be shared in more detail in the next part of this article.

6. Get Summary and click “Sign & send”

You will be attached with a summary of the amount of income you declared, all the reliefs and exemptions you claimed and the amount of tax you will pay.

You will know what percentage you are taxed. Then, you just need to click ‘Next’ after confirming the details.

Once you have made sure that all the information you entered is correct, click ‘Sign and Send’. You can download a copy of your e-Form for your safekeeping.

List of 2023 Tax Exemptions for E-Filing 2024

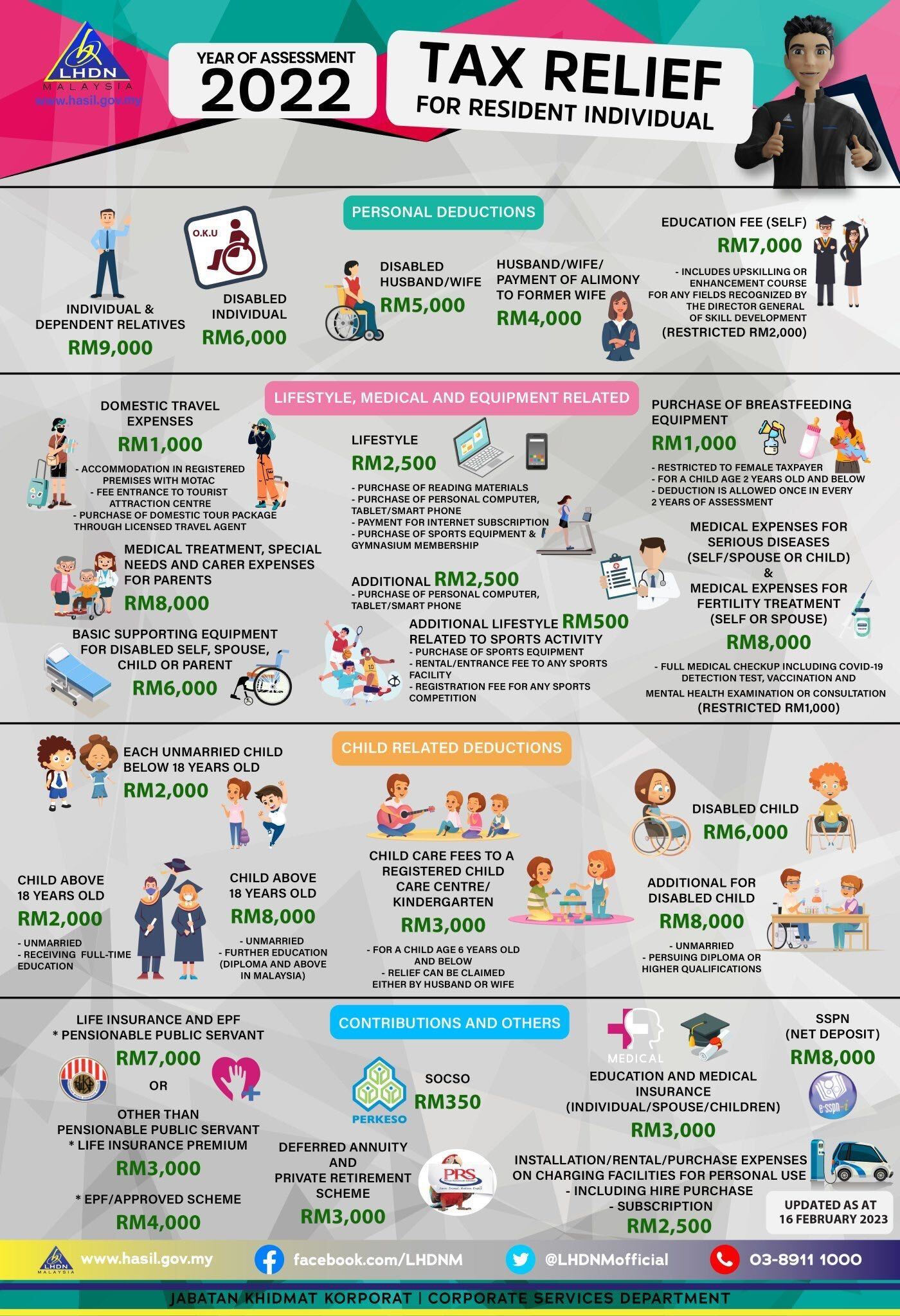

Okay, now let’s look at the list of 2021 tax exemptions for e-filing 2022 for you to claim! Please note that you can claim the items below for expenses incurred on or before 31 December 2021 only. Here is an infographic from IRB for your reference:

1. Life Insurance

First on the list is life insurance. Who can claim? If you are a private sector employee and civil servant who does not have a pension, you are eligible for tax relief of RM3,000 for life insurance and RM4,000 for EPF. In addition, civil servants with pensions are also eligible to claim tax relief of up to RM7,000 for life insurance premiums.

2. Education and Medicine

Do you have an education insurance and medical insurance plan? If so, you are in luck because apart from life insurance, you can claim tax relief of up to RM3,000 on premiums paid for education insurance plans and medical insurance. It’s not just insurance for yourself, you can also insure your spouse and children.

3. Private Retirement Scheme (PRS)

In addition to mandatory contributions to the Employees’ Provident Fund (EPF), you can plan your retirement finances with the Private Retirement Scheme (PRS). This PRS is a long-term investment savings scheme to help you financially after retirement. If you have a PRS, you are eligible for tax relief of up to RM3,000 when filing tax next year.

4. Tuition Fees

For those of you who continue your studies by paying your own fees at a recognized higher education institution, you can claim tax relief of up to RM7,000! If you are pursuing a Master’s or Doctoral degree, then any course of study is eligible for this tax relief.

5. National Education Savings Scheme (SSPN)

The SSPN is a government-backed savings plan to encourage parents to invest in their children’s higher education. If you have children and invest with SSPN, you can get tax relief of up to RM8,000 for their annual net deposits. So far, the rate of dividend or return in recent years has been recorded at about 4%.

6. Medical Treatment Expenses

You can also claim tax relief of up to RM8,000 for medical expenses that have been used for yourself, your spouse and children. However, there are some criteria you have to meet to be eligible to claim.

First, the amount applies to medical expenses for selected serious illnesses for oneself, spouse or children. Medical costs for fertility treatment for yourself or your partner are also included. Second, health check-up expenses for yourself, your spouse and children also allow you to qualify for tax relief but up to RM1,000 only.

In addition, under the Permai stimulus package by the Government, medical expenses such as pneumococcal, influenza and COVID-19 can also claim tax exemption. The tax exemption is given on vaccination expenses for oneself, spouse and children limited to RM1,000.

7. Lifestyle Allowance LHDN

for YA2021, you are allowed to claim tax relief of up to RM5,000 under this category (not the usual RM2,500 allocated in previous years), but there are conditions for it. The first RM2,500 of that amount can be claimed for the purchase of lifestyle equipment for personal use by you and your family, including:

- Reading materials such as books, journals, magazines, printed newspapers and other publications (excluding e-newspapers)

- Gym membership and purchase of sports equipment

- Internet subscription fee

- Personal computer, laptop, smartphone or tablet

Meanwhile, the remaining RM2,500 can only be claimed for the purchase of technology gadgets such as laptops, smartphones and tablets made between 1 June and 31 December 2021.

8. Local Tourism

Traveling within the country can also get a tax exemption! You can claim up to RM 1,000 for domestic travel expenses if you stay at a registered accommodation or purchase an entrance fee to a registered tourist attraction. The scheme was launched under the 2020 Economic Stimulus Package and has since been extended until 31 December 2021 as well.

Recently, under Budget 2022, this special tax relief has also been extended further for YA2022.

Where there is a will, there is a way. After this, you can save a little more money by taking advantage of the tax relief you are eligible to claim. It should be noted that this list may change from year to year. So, before you pay your income tax next year, make sure you know the list of tax exemptions for 2024.

Hopefully the list that Qoala has shared in this article will help you to manage your finances wisely. If you are looking for the best car insurance, you can get it at Qoala at a very reasonable price. Get your car insurance at Qoala now!

EN

EN

MY

MY