Unit Trust, also known as Unit Amanah in Malaysia, is an investment institution established to collect funds from small-scale investors into a trust fund. The fund is then invested in the stock and equity markets by the Unit Trust Management Company on behalf of the investors through a trust agreement. In other words, you entrust the fund manager to manage and invest your money on your behalf.

Invest in Unit Trust Investment? Key Preparation Tips

Investing in Unit Trust is a suitable investment instrument for those who have limited capital but want to venture into stock market investments. It can help you achieve your financial goals and enjoy the lifestyle you desire. If you are interested in investing in Unit Trust, here are some things you need to know for your reference and guidance:

1. Understand the Basic Concept of Unit Trust Investment

Unit trust investment is one of the popular collective investment instruments in Malaysia. Collective in this context means that the funds of investors will be pooled into a trust fund. This fund will be managed by professional and certified fund managers who are under the management of Unit Trust Management Companies. This means that investors do not directly participate in the stock market, but only buy units in a stock fund portfolio.

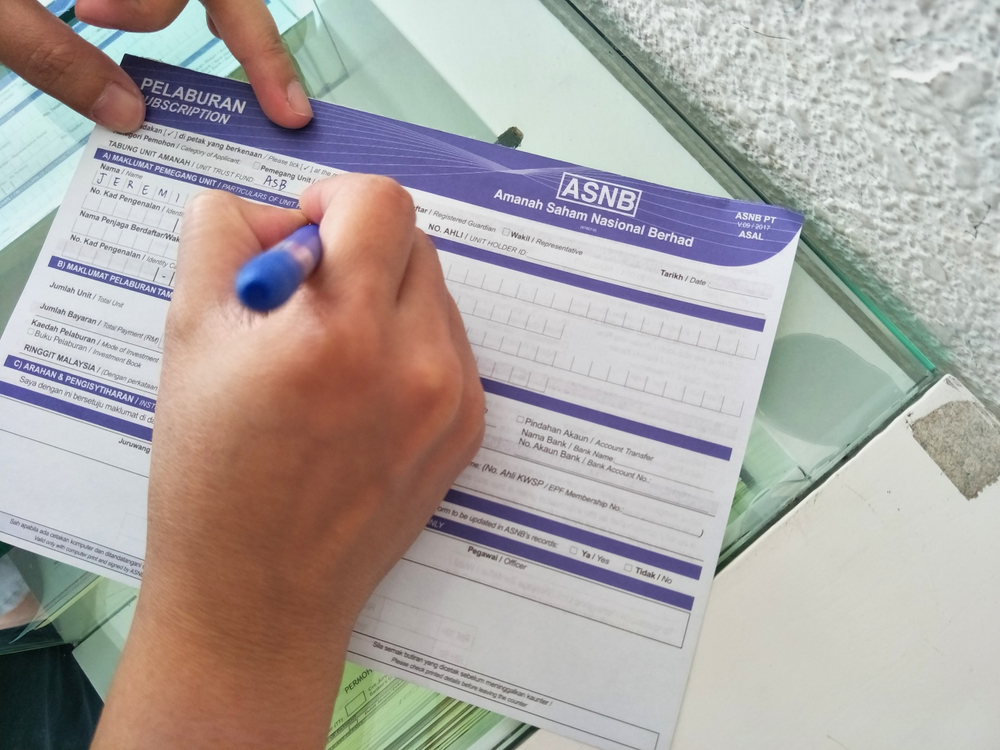

Investment matters will be managed by fund managers who play a role in selling or buying shares of companies that have the potential to benefit investors. Basically, the concept of Unit Trust can be said to be the same as ASB investment. The difference is that the profits from ASB can be seen through the ASB bonus and dividends announced every year, while Unit Trust investments will earn investment benefits in the form of dividends or an increase in the price of the Unit Amanah purchased.

2. Identify Your Risk Tolerance

In general, investment risks are divided into three categories – low risk, moderate risk, and high risk. The higher the risk of an investment, the higher the potential returns or losses that may be faced. In the context of Unit Trust, it can be categorized as a moderate-risk investment. However, the investment risk depends on the objective of the selected fund itself. Investing in Unit Trust carries various risks, including low, moderate, and high-risk investments. Therefore, it is advisable to choose an investment fund that is suitable for your risk tolerance level.

3. Know Your Investment Capital

Unit Trust investment does not require a large amount of capital compared to stock or property investments. Therefore, this investment is very suitable for young people who are just starting out and are interested in the world of investment. Some funds require a minimum investment of as low as RM100, while others require a higher amount to start investing in Unit Trust.

In addition, you are also advised to identify the amount required to add more units in the trust fund. This is because each Unit Trust sets different conditions for adding unit holdings – some as low as RM50 or RM100, depending on the chosen Unit Trust. As Unit Trust investment is a long-term investment, you need to determine the appropriate fund for you to ensure that you invest consistently every month.

4. Comparing the Performance of Funds

Every individual who chooses to invest certainly expects their investment to grow, with high profit and minimum loss rates. Therefore, you need to compare the performance of each fund in the same category before choosing the best one. For example, if you want to invest in an equity fund, compare the performance of several companies that offer the same fund. This approach can help minimize the risk of loss to some extent.

5. Make Sure to Register With the Securities Commission

In Malaysia, there are many investment options that you can choose from depending on your needs and objectives. However, you need to be careful to avoid falling victim to scams by scammers. Take precautionary measures by ensuring that the Mutual Fund you have selected is registered with the Securities Commission before starting to invest. The Securities Commission (SC) is an authoritative body that regulates all types of investments in Malaysia.

List of Unit Trusts in Malaysia

Unit Trust investment is one of the best steps to diversify your investment portfolio and gain access to different markets. To help you choose the right Mutual Fund investment for you, below are some of the best Unit Trusts in Malaysia that you can consider:

-

-

- Amanah Mutual Berhad;

- Amanahraya Investment Management Sdn Bhd;

- BIMB Investment Management Berhad;

- Maybank Asset Management Sdn Bhd;

- Hong Leong Asset Management Berhad;

- KAF Investment Funds Berhad;

- Amanah Saham Nasional Berhad;

- Saham Sabah Berhad;

- Manulife Asset Management Services Berhad;

- Kenanga Investors Berhad;

- Permodalan BSN Berhad;

- RHB Asset Management Sdn Bhd;

- Affin Hwang Asset Management Berhad;

- Amanah Saham Sarawak Berhad.

-

You can conduct a survey and choose whichever is suitable for your investment objectives. In addition to this list, there are many other Unit Trusts in Malaysia that you can explore. For the record, there are as many as 38 Mutual Fund Management Companies registered under the Securities Commission of Malaysia as of April 2021.

6. Choose Shariah-Compliant Unit Trust Funds for Investment

If you are a Muslim, you need to ensure that the funds you want to invest in comply with Islamic Shariah principles. This is to ensure that the returns obtained from Shariah-compliant investments come from sources that are halal and do not have any elements of riba (interest), gambling, or uncertainty.

7. Take into Account the Investment Costs to be Incurred

Unit Trust investment is subject to certain costs that must be paid to the Mutual Fund Management Company depending on your investment amount. Below are some of the Mutual Fund investment fees that you need to bear if you invest with a Unit Trust:

Management Fee

It refers to the fee that needs to be paid to ensure that your funds are managed professionally. Usually, the management fee rate is around 0.4 percent to 1.5 percent of the net asset value (NAV), depending on the amount of funds invested.

Annual Unit Holder Fee

This fee is charged for administrative and management costs and usually ranges between 0.04 percent and 0.1 percent per annum of your NAV. This fee also depends on the type of fund chosen.

Switching Fee

Basically, unit holders can switch from one managed fund to another. The minimum investment that can be switched in each transaction is RM1,000 and the units are traded in the transaction at the net asset value (NAV) per unit. Usually, the fee for switching from a money market fund to another fund is around RM24 per transaction or up to six percent of the amount of funds being switched.

Sales Charge

This sales charge is imposed when you buy a Unit Trust. Usually, you need to pay an additional six percent when you buy directly or through an agent. Meanwhile, a three percent charge will be imposed on all approved funds if the units are purchased through the KWSP Member Investment Scheme. However, no charges will be imposed for repurchases.

One other thing you need to know before investing in Unit Trust is that the Unit Trust is NOT protected by the Malaysia Deposit Insurance Corporation (PIDM). Therefore, you are advised to consider your financial situation before, during, and after investing. What’s important is not to be afraid to seek opinions or further advice from experts in Unit Trust.

Unit Trust Investment Malaysia: Is Investing in Unit Trust the Right Choice?

Investing in Unit Trust is a long-term investment. It is one of the investment instruments that can be considered if you are willing to take high risks. The money you invest, whether it is retirement savings or pension funds, will be put into a trust fund that will be managed by a responsible party. Therefore, you need to choose the appropriate fund to help you achieve your financial goals. In addition, if you are planning to get car insurance with an easy, fast, safe, and affordable process, visit the Qoala website for more information.

EN

EN

MY

MY