After the Ministry of Transport announced that private vehicle owners no longer need to display physical road tax stickers on their car windshields and physical driving licenses, various questions arise regarding the implementation of digital road tax and digital driving licenses. While many have welcomed this step, there are still concerns regarding safety issues and the accessibility of digitizing road tax.

Will Digital Road Tax and Digital Driving License Make Your Transactions Easier or Otherwise?

The enforcement of digital Driving License (LLM) and Vehicle License (LKM) came into effect on February 10, 2023. This measure was taken to facilitate the transactions of road users by presenting only the digital road tax and digital driving license through smartphones.

To do so, you need to use the JPJ portal or the MyJPJ application. Through this application, you can also check personal information and vehicle details stored in the JPJ database, such as:

- Driving license;

- Vehicle road tax;

- Driving test results;

- Reports on stolen cars;

- JPJ summonses.

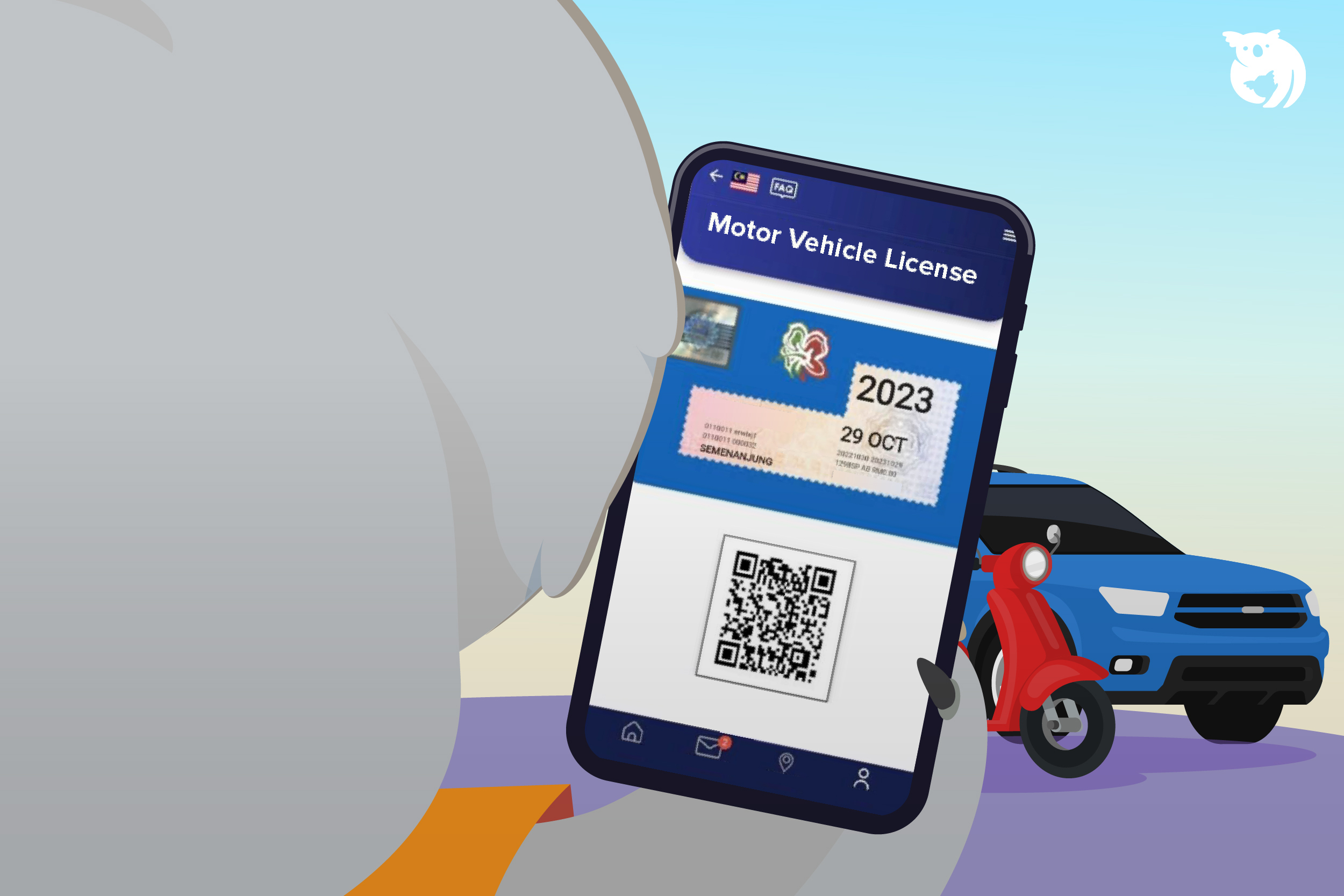

You no longer need to wait in long queues at the JPJ office to obtain a physical copy of your vehicle’s road tax with the availability of digital road tax. You simply need to open the My JPJ application and show the digital road tax with a QR code to the authorities. Enforcement officers will scan this QR code to verify the validity of your road tax. For your information, this QR code can only be read by the devices provided to JPJ and PDRM enforcement officers.

How to Check Digital Roadtax Digital (e-LKM) and Digital Driving License (e-LMM) Online via MyJPJ

If you don’t have a MyJPJ account yet, you need to register first. Here are three easy steps to check digital road tax and digital driving license through MyJPJ:

1. Download the MyJPJ Application

You can download the MyJPJ application from the Apple Store if you are an Apple product user, or from the Google Play Store if you are an Android product user.

2. Register a New Account

If you already have an account, you can simply log in to the application. However, if this is your first time using MyJPJ, you need to register a new account by providing important information such as:

- Full name;

- Identification card number;

- Valid email address;

- Valid mobile phone number.

Make sure to double-check your information to ensure that all details provided are accurate. Then, you can create your password.

3. Check Your Digital Road Tax and Digital Driving License

After registering, you can proceed to check your driving license and road tax through the JPJ portal by following these steps:

- Log in to the MyJPJ portal or application that you have downloaded;

- On the main page, click on the ‘Profile’ icon located at the bottom right corner of the screen;

- Your digital driving license will be displayed;

- Click on the “Motor Vehicle License” or “Roadtax” tab, and information regarding your road tax and vehicle will be shown.

What Else Do You Need to Know About the Implementation of Digital Road Tax?

The implementation of digital road tax is done to facilitate us as road users. You may still have doubts about digital road tax.

Is it Mandatory to Download the MyJPJ Application?

The use of the MyJPJ application to obtain digital copies of your driving license and road tax is an optional convenience. Individuals who do not have access to technology or the internet can still obtain physical copies from the JPJ.

Will You Be Fined for Failure to Show the Digital Road Tax?

As mentioned earlier, the use of the application is not mandatory, and you will not be fined for failing to show the digital road tax. Enforcement officers can verify the status of your road tax and license through their systems.

What if You’re Driving Someone Else’s Vehicle That Doesn’t Display the Road Tax Sticker?

You can ask the vehicle owner to print a copy of the digital road tax to keep in the vehicle. If authorities want to inspect the road tax, you can show them the printed copy. However, even without a printed copy of the digital road tax, authorities can still verify the information through their devices.

Is the Digitization Implementation for All Vehicles?

The digitization of road tax and driving licenses is still in its initial stages and currently limited to private vehicles, as mentioned earlier. However, there are still certain categories of vehicles that are required to display physical driving licenses and road tax.

Driving License

The following driving license categories are still required to display a physical driving license:

-

- Learner Driving License (LDL);

- Vocational License holders (PSV/GDL/KON);

- Malaysian Driving License for Foreigners;

- Foreigners Driving with an International Driving Permit (IDP).

Road Tax

The following road tax categories are still required to display a road tax sticker:

-

- Company Private Vehicle Road Tax (LKM Persendirian Syarikat);

- Foreigners’ Vehicle Ownership;

- Commercial Vehicles including Goods Vehicles and Public Service Vehicles.

The implementation of digital road tax will facilitate your transactions as a road user. This step will also help authorities to monitor more effectively and reduce attempts of fraud related to road tax and driving licenses.

Furthermore, if you’re looking to renew your car insurance, you can consider Qoala to enjoy more savings. Qoala is the best online insurance comparison platform in Malaysia. You can easily and quickly get the best car insurance in Malaysia at affordable prices.

- Buy Insurance Online – The process of purchasing or renewing car insurance can be done easily from home without the need to visit post offices or JPJ counters.

- Compare Insurance Products – You can compare quotes from various top insurance companies in Malaysia.

- Receive Instant Quotes – Receive lightning-fast free quotes to better protect your car.

EN

EN

MY

MY