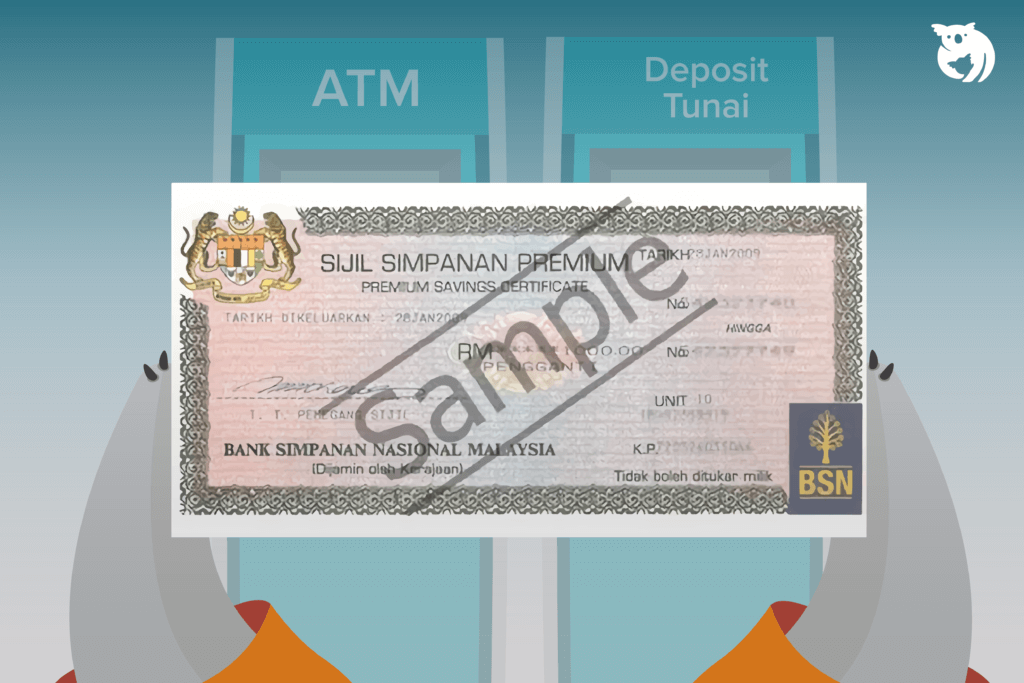

The BSN Sijil Simpanan Premium, also known as SSP (Simpanan Premium BSN), is one of the savings schemes introduced by Bank Simpanan Nasional (BSN) in 1978. It was introduced to encourage the public to save and educate the community about good financial planning and management.

9 Things to Know About BSN Sijil Simpanan Premium 2023

Customers who participate in the BSN Sijil Simpanan Premium not only have the opportunity to earn returns on their savings but also have the chance to win prizes through the monthly draw of the Premium Savings Certificate.

For those who need to become more familiar with the BSN Sijil Simpanan Premium 2023, here is complete information about SSP BSN to help you better understand this savings scheme.

1. What is BSN Sijil Simpanan Premium?

BSN Sijil Simpanan Premium (or SSP BSN) is a savings account based on the Mudharabah contract (profit-sharing). The funds from SSP are invested in Shariah-compliant instruments and assets, and the contributed prizes are sourced from the Islamic Banking Scheme (SPI) funds of BSN.

In addition to the savings benefits, customers who open an SSP BSN account and meet the eligibility criteria have the opportunity to win various attractive prizes through monthly draws. Moreover, the government guarantees the deposited funds and is eligible for income tax exemptions.

2. Eligibility Requirements for BSN Sijil Simpanan Premium

For those interested in participating in the Premium Savings Certificate (SSP), the following are the requirements set by Bank Simpanan Nasional for your reference and guidance:

Open to Malaysian citizens, permanent residents, and foreigners with a permanent address in Malaysia.

- Aged 12 years and above.

- Minimum deposit of RM10 (per unit) with no maximum limit.

3. How to Purchase BSN Sijil Simpanan Premium

The BSN Sijil Simpanan Premium account is open to anyone aged 12 years and above, with a minimum investment value of RM10. As a parent, you can open this savings account for your children. It can be used for educational purposes, eliminating the need to apply for educational loans for further studies.

For new customers, the purchase of BSN SSP can only be made through any BSN branch counter near you nationwide. You will need to provide the following documents:

- Identification card (IC)

- Fully completed BSN Basic Savings Account Application Form

- An initial deposit of RM10.

4. How to Save BSN Sijil Simpanan Premium (SSP) Bank Simpanan Nasional

You can save BSN Sijil Simpanan Premium through various methods. For existing customers, you can make SSP deposits through BSN branch counters, ATMs, CDM machines, myBSN internet banking, or via BSN Bank Agents.

i. Saving SSP BSN via ATM or CDM

To save SSP BSN through this method, existing customers can make deposits using ATMs or CDM (cash deposit) machines.

BSN Sijil Simpanan Premium Deposit via ATM

To save through an ATM, you can follow these steps:

-

- Insert your ATM card or BSN debit card;

- Select the language and enter your PIN number;

- Then, select Premium Savings Certificate;

- Enter the amount in multiples of RM10;

- Confirm the deposit and save the transaction receipt.

BSN Sijil Simpanan Premium Deposit via CDM (with BSN ATM/Debit Card)

For deposits through the cash deposit machine, here are the steps you can take:

-

- Insert your ATM card or BSN debit card;

- Select the language and enter your PIN number;

- Then, select Premium Savings Certificate;

- Choose the deposit method (account debit or cash);

- Enter the amount or deposit money in multiples of RM10;

- Confirm the deposit and save the transaction receipt.

BSN Sijil Simpanan Premium Deposit via CDM (Without BSN ATM/Debit Card)

Deposits through the cash deposit machine can also be done without a card. However, this method applies to existing customers only. Here’s how to save SSP BSN using the CDM machine for your guidance:

-

- Select the language;

- Then, select Premium Savings Certificate;

- Enter the BSN Giro/Giro-i savings account number;

- Deposit money in multiples of RM10;

- Confirm the deposit and save the transaction receipt.

ii. Saving BSN Sijil Simpanan Premium via myBSN Internet Banking

To facilitate your savings, SSP BSN can also be saved through myBSN Internet banking. You can save using the following methods:

-

- Visit the BSN website at www.mybsn.com.my;

- Select BSN eSSP Savings;

- Choose an account number from the list;

- Then, complete the required information;

- Confirm the deposit and print the transaction receipt.

iii. Saving BSN Sijil Simpanan Premium through Registered Bank Agents

You can also save SSP Bank Simpanan Nasional through registered bank agents. Here are the steps you can follow if you want to save through a registered bank agent:

-

- Present your identification card and cash (for new customers) or BSN ATM/Debit card or cash (for existing customers) to the bank agent;

- The bank agent will process the SSP deposit at the POS terminal;

- Confirm the deposit and save the transaction receipt – the maximum deposit for each transaction is up to RM1,000.

5. Dividend Sijil Simpanan Premium BSN 2023

In general, the rate of profit for BSN SSPN depends entirely on the amount in your account. Here are the dividend rates for BSN Premium Savings Certificate as a reference:

| Minimum Amount | Maximum Amount | Dividend BSN Sijil Simpanan Premium |

| RM10 | RM5,000 | 0.11% p.a. |

| RM5,001 | RM50,000 | 0.16% p.a. |

| RM50,001 | No maximum value | 0.35% p.a. |

6. Category BSN Sijil Simpanan Premium

For the year 2023, a total of 10 categories are introduced to encourage the habit of saving among the Malaysian people through the BSN Premium Savings Certificate (BSN SSP). You can refer to the complete savings categories as follows:

| Category | Eligibility Requirements | Prizes to be won |

| Millionaire Draw |

|

*Minimum savings period of 90 days does not apply to the April Millionaire Draw

|

| Monthly Draw |

|

|

| Regional Draw*

*Regional Division: North (Kedah/Perlis, Penang, Perak), South (Negeri Sembilan, Melaka, Johor), East Coast (Pahang, Terengganu, Kelantan), Central (Kuala Lumpur, Selangor), and East Malaysia (Sabah, Sarawak) |

|

|

Young Saver Draw |

|

|

| Loyalty Draw |

|

|

| New Saver Draw |

|

|

| Teacher’s Draw*

*Teachers defined as kindergarten/primary school/secondary school/private school/international school/registered religious school under the Ministry of Education Malaysia (MOE). Lecturers under the Ministry of Higher Education (MOHE), including MOE and MOHE staff, are also eligible. |

|

|

| Salary Account Draw (Participation Multiplier) |

|

|

Kasih Draw**Special draw for recipients of Rahmah Cash Contribution (STR) or any Financial Assistance through BSN Channel. |

|

|

| Consistent Saving Draw*

*Minimum continuous saving for three (3) consecutive months starting from January 2023. Special Additional Bonus |

|

|

| Special Additional Bonus |

|

7. Maturity Period of BSN Sijil Simpanan Premium

The maturity period of BSN Sijil Simpanan Premium is 45 days from the date of your purchase.

8. Draw Date of BSN Sijil Simpanan Premium 2023

Customers who save through BSN Sijil Simpanan Premium can refer to the draw dates of BSN SSP 2023 to check the results of their Sijil Simpanan Premium. Here are the draw dates of BSN Sijil Simpanan Premium for your reference:

| BSN SSP Month Draw | BSN SSP Date Draw | BSN SSP Location Draw |

| Januari | 4 Jan 2023 | Auditorium BSN / Facebook Live BSN Malaysia |

| Februari | 4 Feb 2023 | |

| Mac | 1 Mac 2023 | |

| April | 6 Apr 2023 | |

| Mei | 3 Mei 2023 | |

| Jun | 8 Jun 2023 | |

| Julai | 5 Jul 2023 | |

| Ogos | 2 Ogos 2023 | |

| September | 7 Sep 2023 | |

| Oktober | 4 Oct 2023 | |

| November | 2 Nov 2023 | |

| Disember | 6 Dis 2023 |

9. Checking the Results of BSN Sijil Simpanan Premium 2023

To check the results of BSN SSP draw, you can follow any of the following methods:

i. Check BSN SSP Draw 2023 via Bank Simpanan Nasional Website

Through this method, you can check the results of Sijil Simpanan Premium by:

-

- Visit the official website of Bank Simpanan Nasional;

- In the Check Results Here section, enter your identification card number or SSP certificate number.

ii. Check BSN SSP Draw 2023 via myBSN Internet Banking

Through this method, you can check the winners’ results by:

-

- Log in to myBSN Internet banking;

- Click on the Islamic Banking menu, then selecting Savings;

- Your Sijil Simpanan Premium will display;

- Click on the Check SSP Results submenu;

- Enter your identification card number or Sijil Simpanan Premium number, then click Submit;

- The screen will show whether you have been successful or not.

iii. Check BSN SSP Draw 2023 at BSN Branch or Counter

Customers can also visit any Bank Simpanan Nasional counter and check the BSN SSP draw results with the attending officer.

iv. Check BSN SSP Draw 2023 via Bank Simpanan Nasional Official Facebook

Additionally, you can visit the official Bank Simpanan Nasional Facebook page to get the latest updates on the BSN SSP draw results for 2023.

Start Saving for a More Secure Future

The habit of saving can help you prepare an emergency fund that can serve as an emergency fund. Similar to insurance coverage, having sufficient savings can alleviate burdens and provide peace of mind in case of unforeseen circumstances.

Therefore, you may consider the Sijil Simpanan Premium as one of your savings methods. Additionally, if you want to obtain medical and health insurance for additional protection for your future, visit the Qoala website for more information. Qoala is the best insurance comparison and renewal platform in Malaysia.

EN

EN

MY

MY