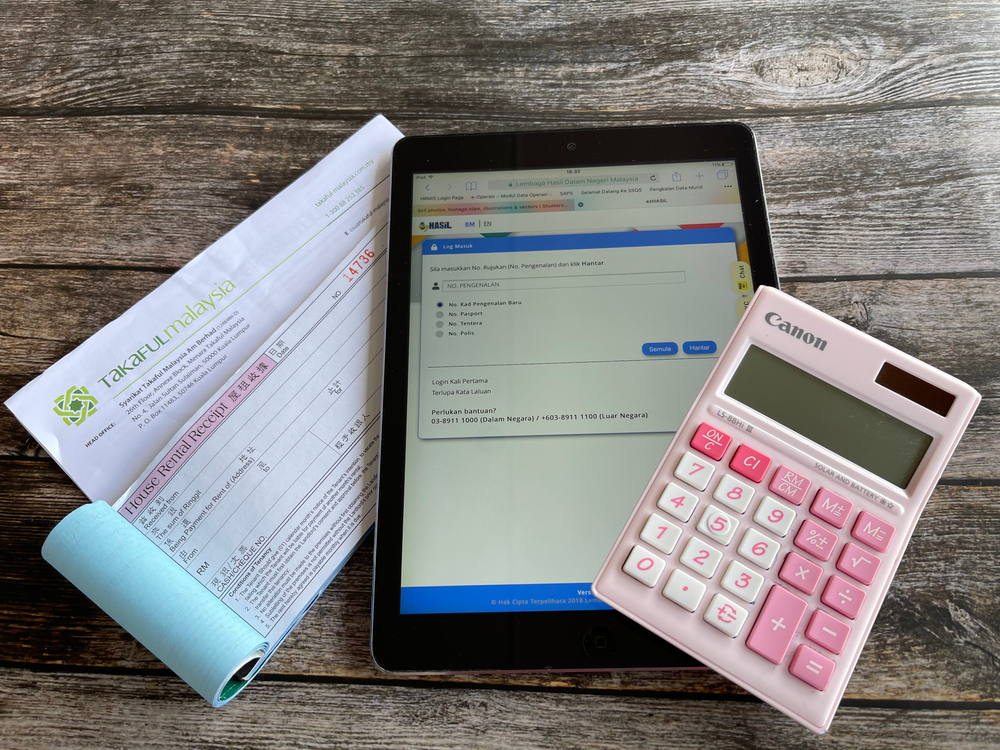

Declaring income tax can be quite daunting, especially if you are doing it for the first time. For new taxpayers who have not yet registered, this article will guide you on how to easily register your income tax through e-Daftar LHDN.

3 Steps to Register as a First-Time Taxpayer in Malaysia

Individuals with income who are liable for tax need to file an e-Filing or declare their income tax annually. According to the Inland Revenue Board of Malaysia (LHDN), individuals with a minimum income of RM34,000 per year or RM2,833 per month after KWSP deductions must register for tax filing.

If you meet these requirements, you need to register as a taxpayer and sign up for e-Filing. Here is a guide for your reference:

1. Register as a Taxpayer via e-Daftar LHDN

You can register as a first-time taxpayer by visiting any nearby LHDN branch or by registering through the e-Daftar LHDN portal. If you choose to register online, select the “Individual” category for “Taxpayer Type.”

Once your application is submitted, you can check your application status via e-Daftar LHDN. Additionally, you can also check your income tax status by contacting LHDN at 03-8911 1000.

2. Receive a One-Time Password for e-Filing

After registering as a taxpayer, you need to sign up for e-Filing via the ezHASiL platform. First-time e-Filing users must obtain a 16-digit PIN from any nearby LHDN branch.

3. Log In to e-Filing to Set Up Your Account

Once you have your PIN, visit the new MyTax LHDN service portal. Follow these steps:

- Click on “First-Time Login”;

- Enter your PIN and identification number, then click “Submit”;

- After logging in, complete your account setup by filling in the required information;

- Create a new password for future logins. Ensure it’s something you can remember;

- Set up your security phrase. This acts as a second layer of security to prevent unauthorized access to your account. Similar to online banking, this phrase will appear each time you log in to e-Filing;

- Click “Agree,” verify your information, and click “Submit”;

- You’re done – Message “Your Digital Certificate message has been successfully registered. Click here to log in.” will be displayed.

Fulfil Your Responsibility, Register as a Taxpayer via e-Daftar LHDN

We hope this guide helps you understand the income tax registration process better. Now that you know how to register as a taxpayer through e-Daftar LHDN, obtain your PIN for login, and set up your e-Filing account, the next step is to declare your income tax to potentially receive a tax refund.

Additionally, if you want to obtain life and health insurance for tax relief, visit Qoala’s website for more information. You can refer to the provided articles for more details on tax relief for insurance. Qoala is Malaysia’s top insurance comparison platform. You can compare various insurance options to help you choose the best protection for you and your family.

EN

EN

MY

MY